What is crypto trading and how newbies can trade cryptocurrencies?

Discover more about trading the volatile – and risky to the newbies – cryptocurrency markets. Learn how to take a position with CFDs, and then see an example of a crypto trade on ether.

How the newbies can learn to trade cryptocurrencies these are following steps:

- What’s cryptocurrency trading?

- Learn why people trade cryptocurrencies

- Pick a cryptocurrency to trade

- Open a CFD trading account

- Find your crypto trading opportunity

- Take steps to manage your risk and place your trade

- Monitor and close your position

What's cryptocurrency trading?

Cryptocurrency is a digital or virtual currency secured by cryptography, operating independently of a central bank and using a decentralized ledger called blockchain. It's designed to be a medium of exchange, via CFDs (contracts for difference). a store of value, and can be used for payments.

By contrast, when you buy cryptocurrencies on an exchange, you buy the coins themselves. You’ll need to make an exchange account, put up the full value of the asset to open a position, and store the cryptocurrency tokens in your own wallet until you’re ready to sell.

How do cryptocurrency markets work?

The cryptocurrency market is a decentralised digital currency network, which means that it operates through a system of peer-to-peer transaction checks, rather than a central server. When cryptocurrencies are bought and sold, the transactions are added to the blockchain – a shared digital ledger that records data – through a process called ‘mining’.

Learn why people trade cryptocurrencies

trading cryptocurrency is an interactive, first-hand way to learn about digital currency. For others, buying and selling crypto is an investment. The volatility of the crypto market makes it an interesting arena for anyone seeking a new investment

Cryptocurrencies are notoriously volatile. For traders using leveraged derivatives that allow for both long and short positions, large and sudden price movements present opportunities for profit. However, at the same time, these also increase your exposure to risk. In short, the more volatile the market, the more risk you carry when trading it.

When it comes to cryptocurrency as a medium of exchange, there are some advantages to it versus traditional currency. One advantage being privacy. Although cryptocurrency payments are on public record and anyone can look up transaction information and see the contents of a crypto wallet, you don't need to provide any personal information. This mix of privacy and transparency makes it easy to reduce fraudulent activities like identity theft while also proving transactions were carried out correctly. And no matter what happens to the government, your investment is secure.

Another advantage of cryptocurrency is that it’s global, so there’s no need to figure or pay foreign exchange rates, although cryptocurrency isn’t legal in some countries. You also don’t need to worry about bank account restrictions, such as ATM withdrawal limits.

Pick a cryptocurrency to trade for the bigginers:

Cryptocurrency is available as coins or tokens. The difference between them is that tokens are assets that exist on a blockchain, while coins can be virtual, digital, or tangible. Coins are more like traditional money; a digital coin has its own blockchain.

With us, you can use CFDs to trade 11 major cryptocurrencies, two crypto crosses and a crypto index - an index tracking the price of the top ten cryptocurrencies, weighted by market capitalisation.

Our selection includes: Bitcoin, Ethereum, Litcoin, EOS, And more but the popular is the one that launched very soon ago like in 1 week or month ago

How to trade CFDs: Trading CFDs allows you to speculate on shares, indices, cryptos, commodities, forex and more.

Find your crypto trading opportunity

It can be a challenge to find a cryptocurrency besides Bitcoin or Ethereum that might be worth the investment. If you’re somewhat new to cryptocurrency, it’s quite different from traditional investing. You’ll need to know where to go for information and updates and how to analyze them to determine if they have potential.

Leading cryptocurrencies

Trade a selection of the world’s leading cryptocurrencies trading books

example: Cryptocurrency All-in-One For Dummies

Trade wherever, whenever

Deal on an award-winning trading platform and learn from vieos and mobile app

for example: trading view, Meta 4 & 5 (you can use demo account to learn what ypu readed in books)

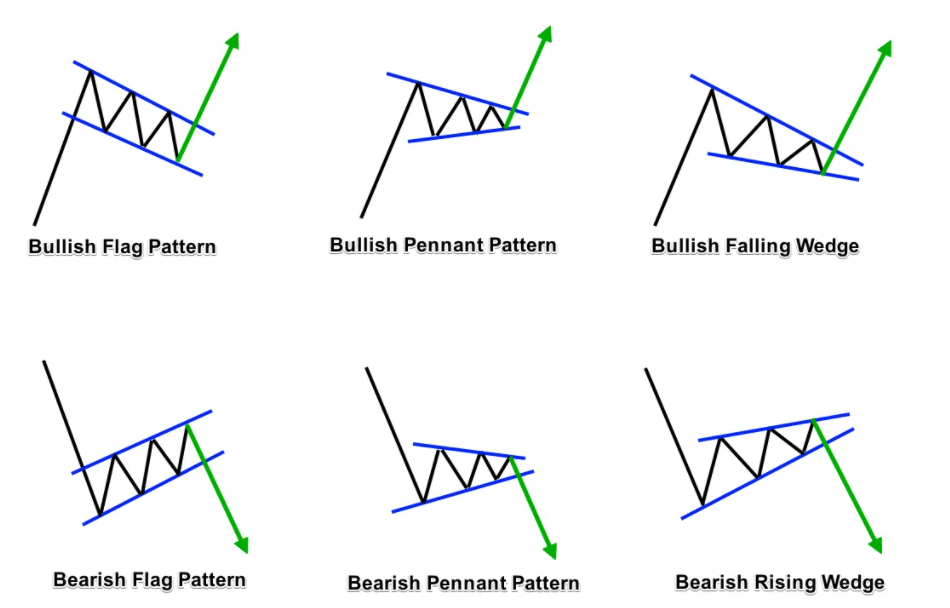

Technical indicators

Discover price trends using trading platform tools like MACD and Bollinger Bands

Expert analysis

Get technical and fundamental analysis from our in-house team and from your mates in trading.

Take steps to manage what you learned your risk and place your trade

Because you’re opening your position on margin, you can incur losses rapidly if the market moves against you. To help manage this risk, you can set a stop-loss level in the deal ticket. If triggered, the stop-loss will automatically close your position and cap your risk

Monitor and close your position

What's Your Reaction?

Like

11

Like

11

Dislike

0

Dislike

0

Love

1

Love

1

Funny

1

Funny

1

Angry

0

Angry

0

Sad

1

Sad

1

Wow

1

Wow

1