Money Smart: How Financial Literacy Is Transforming Lives in Africa

In many African countries, access to money isn’t the problem — understanding how to manage it is. Financial literacy is becoming one of the most powerful tools in the fight against poverty. As more people learn how to save, invest, and budget, entire communities are being transformed.

Introduction

In many African countries, access to money isn’t the problem — understanding how to manage it is. Financial literacy is becoming one of the most powerful tools in the fight against poverty. As more people learn how to save, invest, and budget, entire communities are being transformed.

💡 Why Financial Literacy Matters

-

Many young people enter adulthood without knowing how to budget or save.

-

Small business owners often struggle because they mix personal and business money.

-

People fall into debt traps due to lack of understanding about interest rates and loan terms.

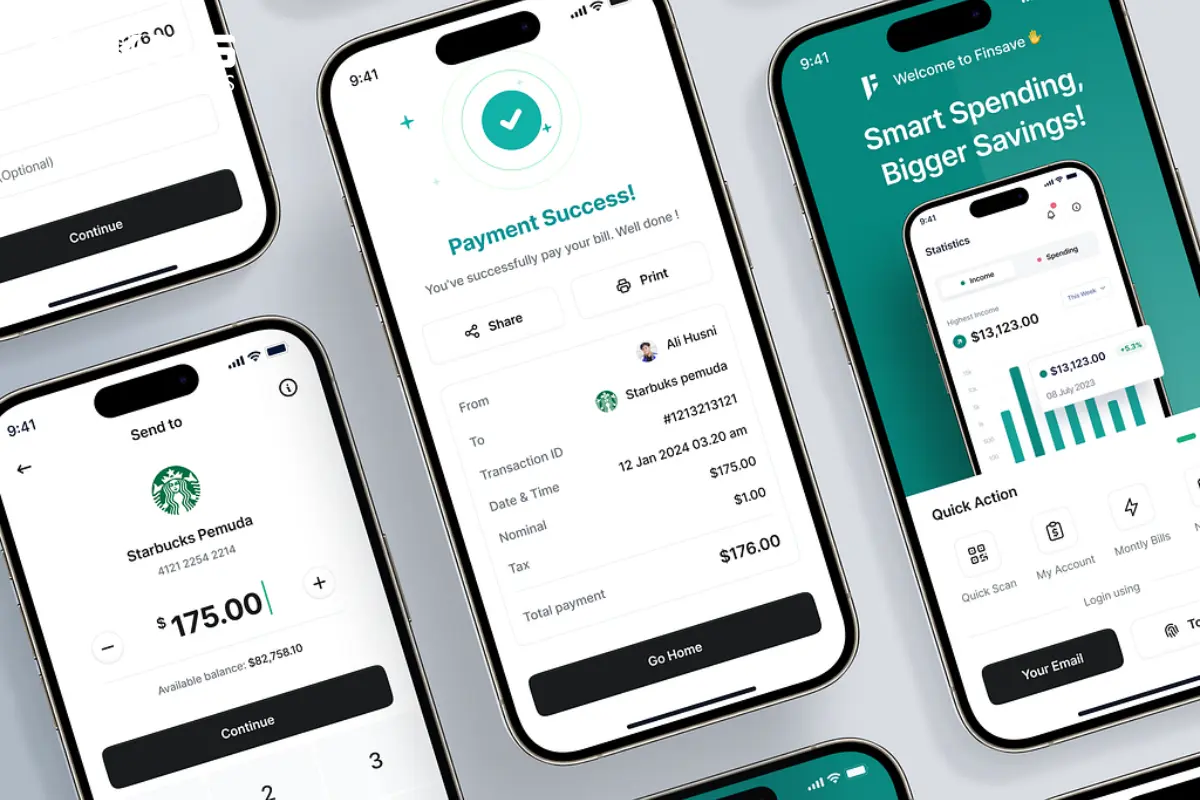

The Rise of Digital Financial Education

Thanks to smartphones and mobile data, financial education is reaching more people than ever before. Apps, podcasts, and YouTube videos in local languages are teaching people how to manage their money better.

🏦 Banks and Fintechs Step In

Banks and financial tech (fintech) startups are launching simple savings accounts, mobile wallets, and micro-loans to help people build healthy financial habits. Some even reward users for watching educational content.

🌍 Impact on the Community

When people understand money, they invest in themselves:

-

Parents can pay for school fees on time.

-

Farmers can plan for low seasons.

-

Families can avoid scams and debt traps.

✅ Conclusion

Financial literacy isn’t just about money—it’s about empowerment. As more people gain the tools to manage their finances wisely, Africa is witnessing a silent revolution. The future is financially brighter when knowledge is shared.

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0